LONDON, Nov 11 (Reuters) – A torrent of delayed U.S. economic data is set to hit over the next month as the government reopens following its longest shutdown on record, but a growing number of Federal Reserve officials doubt the numbers will show the sort of weakness required to cut rates again this year.

After more than 40 days without official economic data, Fed officials seem to be leaning toward the view that the labor market has held up reasonably well, financial conditions remain loose and above-target inflation is going in the wrong direction.

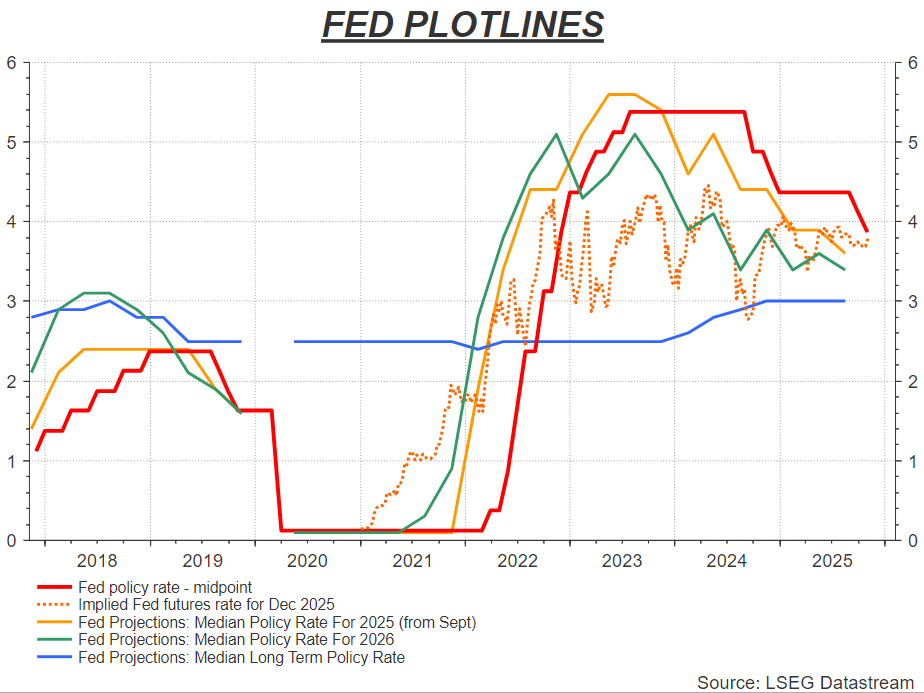

So unless there is a major surprise in the delayed data about to be released, the case for the third interest rate cut of the year is weakening fast. Even though futures still price roughly a two-thirds chance of another cut in December, that may well prove overly optimistic.

While prominent administration voices on the Fed board – most obviously former government adviser Stephen Miran – continue to push for further deep rate cuts, the centrists at the central bank are turning in the other direction.

“It’s very important that we tread with caution here,” St Louis Fed boss Alberto Musalem said on Monday. “There is limited room to ease policy further without policy becoming overly accommodative.”

“It makes sense to proceed slowly as we approach the neutral rate,” Vice Chair Philip Jefferson said on Friday.

These two figures are considered to occupy the middle ground on the Federal Open Market Committee, and they clearly appear to be leaning against another cut before January.

The new year will see a shake-up of the FOMC, as Chair Jerome Powell’s term ends in May, Board governor Lisa Cook’s legal case comes up in January and Miran’s ostensibly temporary role is considered.

But the changes are not expected to be all dovish in 2026, with well-known hawks Lorie Logan at the Dallas Fed and Cleveland’s Beth Hammack both joining the FOMC as voting members.

“We can see the centrists who supported the doves with the first two cuts shifting to support the hawks with a skip if there is no solid evidence the labor market is rapidly deteriorating,” SGH Macro Advisors Fed watcher Tim Duy recently wrote.

LABORING THE STATS

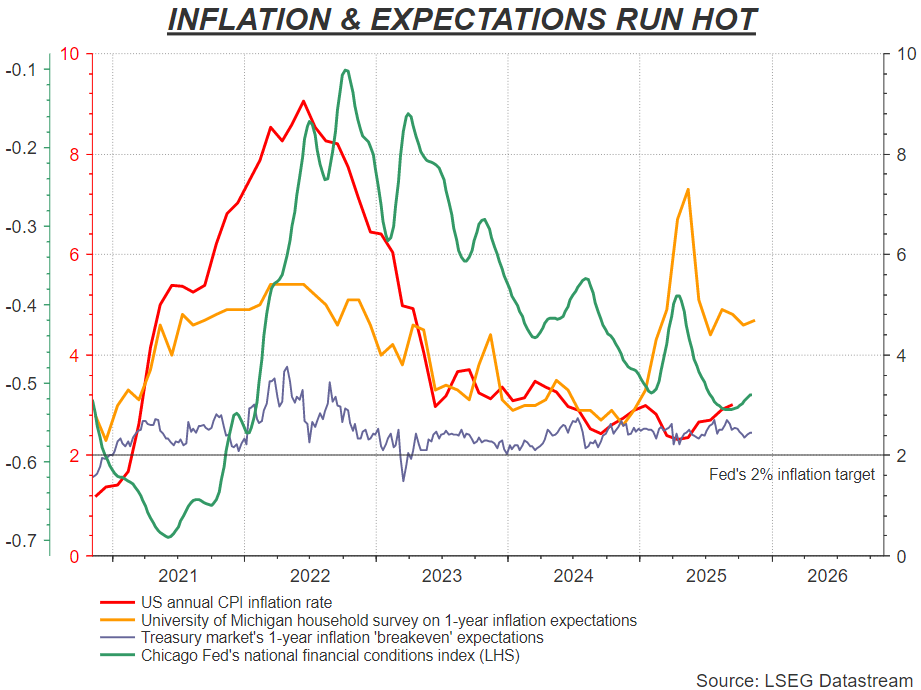

Duy reckons the case for a December pause rests on four main points. Inflation is too high, and policy needs rates to remain slightly restrictive to keep it in check; the labor market is holding up; financial conditions are stimulative; and the last two cuts have bought the FOMC some ‘wait and see’ time.

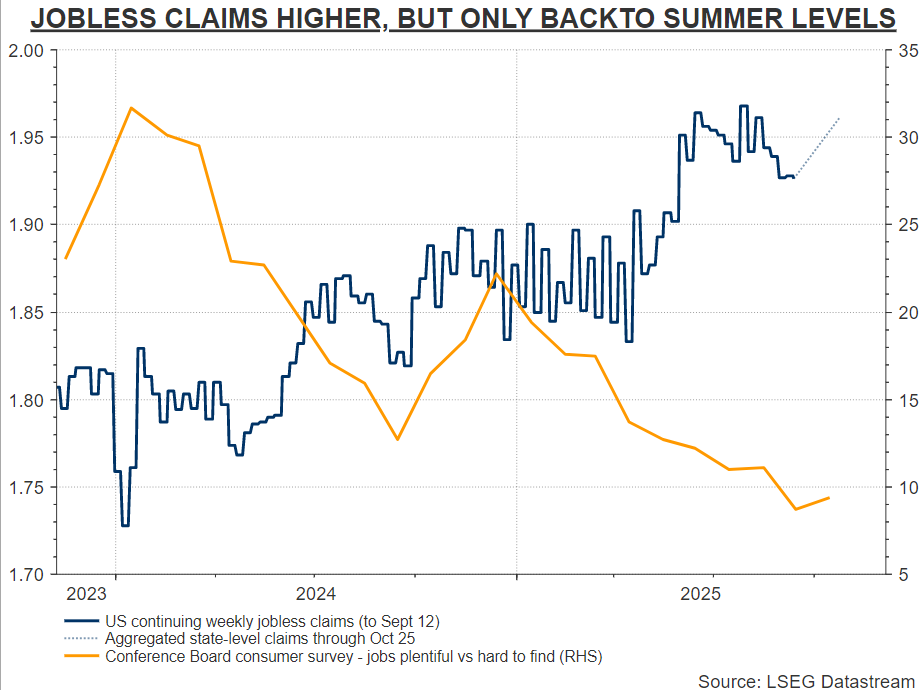

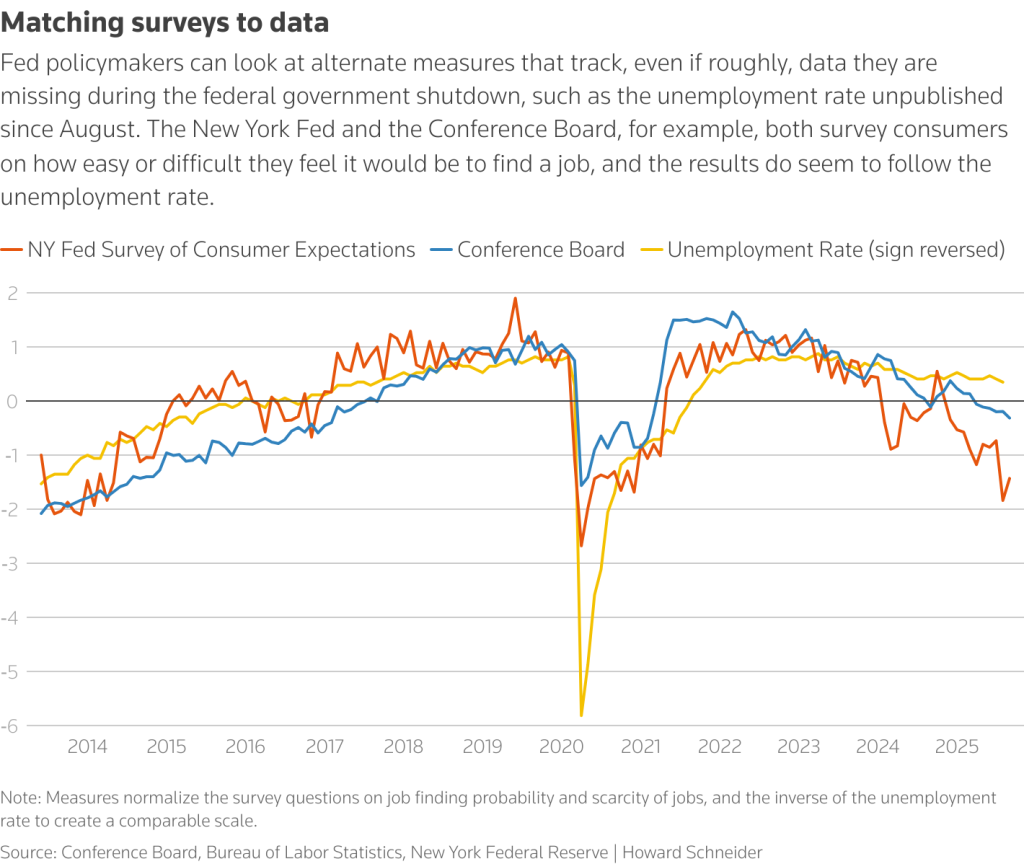

Few Fed analysts disagree about the current state of the inflation picture or financial conditions. The labor market remains the big wildcard — especially given the ongoing data outage.

But there’s no sign that we should expect a major twist in the labor picture when official jobs data is finally released.

While Challenger, Gray & Christmas’ monthly survey did show a jump in layoffs in October, private sector payroll growth has held up well and other measures suggest the labor market remains in a holding pattern.

Perhaps the most convincing sign that unemployment remains under control comes from data that individual states continue to publish about weekly jobless claims.

Haver Analytics aggregated the state-level data, and their results tally with figures crunched by JPMorgan and Citi.

They estimated on Thursday that the number of Americans filing new applications for unemployment benefits increased only marginally last week, pointing to stable labor market conditions through last month. The numbers showed no sign that recent high-profile company layoffs or the government shutdown had boosted claims meaningfully.

St Louis Fed researchers, opens new tab have taken a look at another high frequency cut of the employment picture, data from payroll and scheduling firm Homebase that looks at 100,000 businesses representing around a million workers, mostly in the retail, leisure and hospitality sectors.

The researchers use daily worker-level information from Homebase to replicate the hiring and separation rates seen in the lagged monthly JOLTS survey on job openings – a casualty of the government outage.

Their conclusion was that by late last month, real-time measures of hires and fires has continued a declining trend and net job creation hovered close to zero.

“While these patterns are consistent with moderating employment, the evidence remains too preliminary to assess whether this represents healthy cooling or the start of a more concerning deterioration in labor market conditions,” it said.

The jury appears to be out on that score.

The big decision for Fed policymakers now is whether that equivocal sounding from the jobs world is enough to keep on easing or reason to call it quits for 2025.

The opinions expressed here are those of the author, a columnist for Reuters