Critical information for the trading day

Former U.S. Secretary of Defense Donald Rumsfeld.

It’s time to channel the former U.S. Defense Secretary Donald Rumsfeld, who once said, “There are known knowns; there are things we know we know. We also know there are known unknowns; that is to say we know there are some things we do not know. But there are also unknown unknowns — the ones we don’t know we don’t know.”

As the Federal Reserve gets set to announce its latest monetary policy decision, here are the known knowns.

There is no chance the Fed will lift interest rates. Even reducing the rate of bond purchases is completely out of bounds. But the decision at 2 p.m. Eastern might carry at least one surprise — a known unknown, in Rumsfeld parlance — what the dot plot of economic forecasts says about the timing of a future rate increase, and whether that is slated for 2023 or 2024.

Tim Duy, chief U.S. economist at SGH Macro Advisers, says economists are more likely to see 2023 as the date of a first hike, given the strength of the actual economic data that have come in since the last dot plot was released in March. Traders, by contrast, emphasize the signaling aspect of the dot plot, and that Chair Jerome Powell won’t want to step on his own message about keeping policy loose until the U.S. jobs market shows significant recovery.

“This split in expectations has the interesting implication that there is a general lack of consensus about how the forecasting exercise of the [Summary of Economic Projections] integrates into the new outcomes-based framework,” Duy says.

The Powell press conference will likely be dominated by discussion of when the central bank feels it can reduce the rate of bond purchases. Ellen Gaske, lead economist for G-10 economies at PGIM Fixed Income, says the fourth quarter makes the most sense for the timing of a taper because, by then, the Fed will have answers to key questions, namely whether labor supply increases as extra unemployment benefits expire and schools reopen.

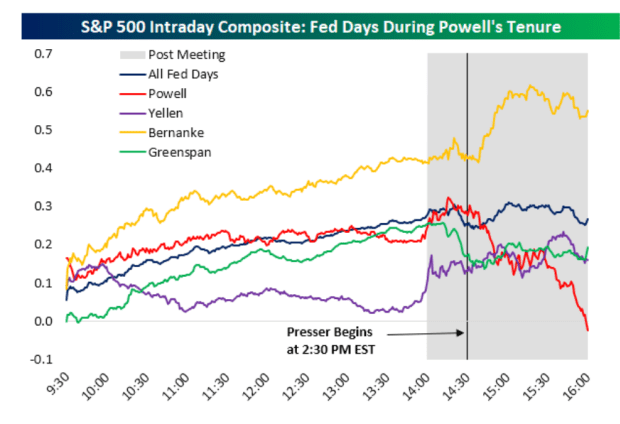

As for the unknown unknowns, they would probably come in the form of answers to reporter questions. It’s worth noting this chart, from Bespoke Investment Group, showing the stock market generally sells off as Powell speaks. (Since the COVID-19 pandemic, the market reaction to Powell has been more benign, the Bespoke analysts add.)

Tech isn’t keeping pace as economy reopens

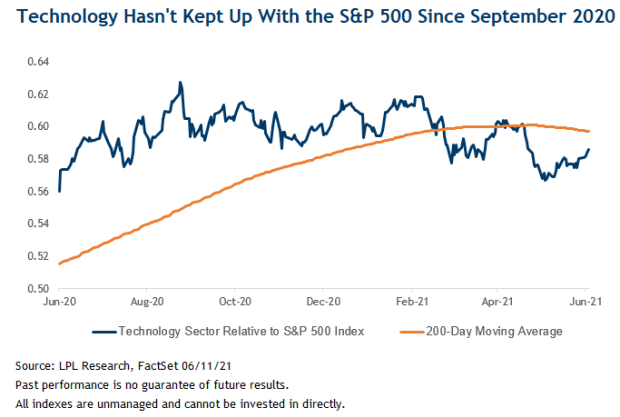

Technology stocks haven’t kept up with the S&P 500 since September 2020, points out Jeff Buchbinder, equity strategist at LPL Financial, which downgraded its view on the tech sector to neutral. Though the sector has strong fundamentals and is innovating rapidly, he argues that cyclical value sectors like financials, industrials and materials will fare better the rest of the year as the economy reopens. A neutral view still means allocating 27% of a portfolio to tech to match its weighting in the S&P 500, he adds.

Speaking of tech, Oracle ORCL, -5.62%, the database software giant, reported stronger-than-forecast fourth-quarter ending May 31 earnings but guided for a weaker-than-expected first quarter due to an increase in investment.

Shortly after the Senate confirmed Lina Khan as a commissioner to the Federal Trade Commission, President Joe Biden named the tech critic to chair the agency.

Biden and Russian President Vladimir Putin meet in Geneva, Switzerland for a highly anticipated gathering between two leaders, who have been critical of each other.

ARK Invest disclosed that it purchased DraftKings DKNG, 0.91% shares worth $42 million on Tuesday, the same day the short-selling research firm Hindenburg alleged the company’s gambling-technology unit operates in countries where gambling is banned. DraftKings says the subsidiary, SBTech, doesn’t operate in any illegal market.

The broader market perspective ahead of the Fed

There probably won’t be much movement before the Fed decision — stock futures ES00, -0.06% were flat — so here’s a broader perspective of what markets have done. The S&P 500 SPX, -0.06% ended Tuesday at its third-highest level in history, up 90% from the March 2020 lows. Oil futures CL.1, 0.49% ended at the highest level since Oct. 10, 2018.

The yield on the 10-year Treasury TMUBMUSD10Y, 1.494%, holding just below 1.50%, is down a quarter point from its Mar. 31 high.

The WSJ dollar index BUXX, -0.02% is up a slender 1% this year. Copper futures HG00, 1.36% have climbed 24%, while gold futures GC00, 0.08% have slipped 2% in 2021.