Bipartisan China bill, markets get quiet and travel restrictions ease.

One down

The Senate passed an expansive bill to invest almost $250 billion in bolstering U.S. manufacturing and technology to compete with China. While both political parties got behind the cause of meeting the challenge posed by America’s biggest rival, Joe Biden’s hope for a bipartisan infrastructure package remains stymied by differences. A proposal to save the deal by a group 58 centrist House members from both parties calls for $1.2 trillion in total spending, versus the $1.7 trillion put forth by the president. The plan by the Problem Solvers Caucus emerged hours after Biden ended talks with Senator Shelley Moore Capito, a West Virginia Republican, after they failed to agree on how to pay for the ambitious project.

Retail craze, Wall Street daze

As legions of retail investors are frantically bidding up meme stocks like ContextLogic, Clover Health and Clean Energy Fuels touted on Reddit, traders on Wall Street have fallen into a summer torpor that may be hard to shake until the Fed’s annual meeting in Jackson Hole. The Bank of America Merrill Lynch GFSI Market Risk indicator — a measure of future price swings implied by options trading on equities, interest rates, currencies and commodities — has fallen to the lowest since before the pandemic first started to roil markets.

Travel hopes

Empty trading floors may be about to get even emptier. The U.S. State Department loosened travel warnings for dozens of nations including France, Canada and Germany, in a move that could ease airline restrictions for people wanting to go overseas as the pandemic wanes in developed countries. The move changes guidance for nearly 60 nations and territories from level 4, or “do not travel,” to level 3, “reconsider travel”. The advisories aren’t binding but can help airlines and other nations set their own restrictions for travel. Meanwhile the European parliament approved vaccine passports. And the EU and the U.S. are set to back a renewed push into investigating the origins of Covid-19 after conflicting assessments about where the outbreak started, according to a document seen by Bloomberg News.

Market calm

Global equities are continuing to trade sideways as investors wait for Thursday’s U.S. inflation report. Overnight the MSCI Asia Pacific Index slipped 0.4% and Japan’s Topix index closed 0.3% lower. In Europe the Stoxx 600 Index was down 0.1% at 5:48 a.m. with miners the biggest losers. S&P 500 futures also pointed to little change at the open, the 10-year Treasury yield was at 1.514% and oil topped $70 a barrel. Bitcoin swung back into the green, paring its weekly loss to 5%.

Coming up…

It’s a light day for data, with mortgage applications due at 7:00 a.m. and wholesale inventories for April at 10:00 a.m. No big change is expected at the Bank of Canada policy decision at 10:00 a.m., with investors on the lookout for fresh hints on its next move to reduce emergency levels of monetary stimulus. The Treasury is set to auction $38 billion in a reopening of 10-year benchmarks at 1:00 p.m.

What we’ve been reading

Here’s what caught our eye over the last 24 hours.

- Bitcoin fall has strategists eyeing $20,000

- Biden-Boris relationship burgeons

- National oil champions are likely to fill the gap

- A buying frenzy for diamonds

- Inflation really does look transitory

- U.K.’s financial center is transformed

- A mysterious particle and the first one second after the Big Bang

And finally, here’s what Joe’s interested in this morning

Yesterday we got the latest JOLTS report, the government survey that looks at other labor market indicators, such as total job openings and the rate at which employees are quitting. The news is pretty straightforward. Job openings continue to surge and workers are quitting at a record pace.

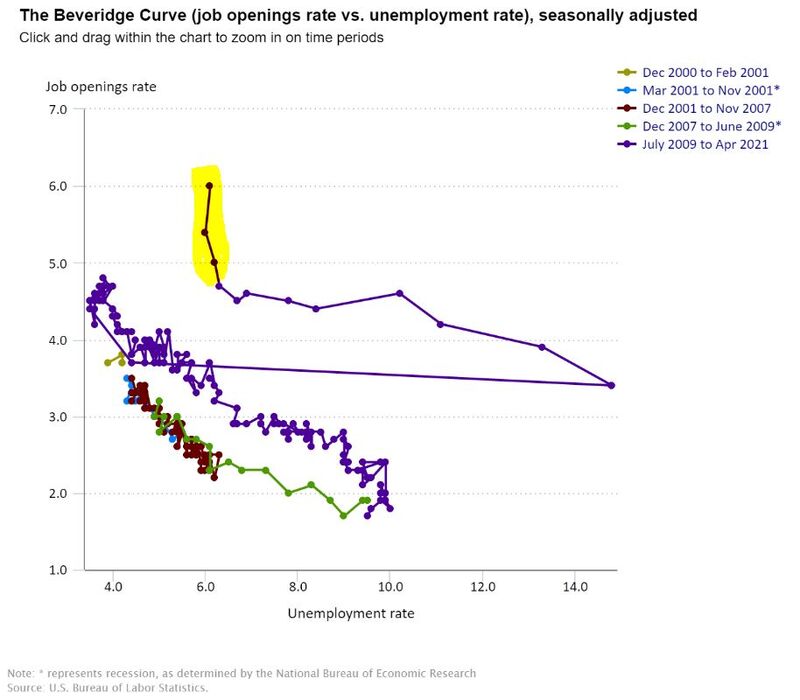

One indicator that economists like to look at is the so-called Beveridge Curve, which plots the unemployment rate against the rate of job openings. Historically there’s been a somewhat stable relationship between the two. Job openings go up and the unemployment rate goes down, as you would expect. But as with everything else weird about this recovery, that’s breaking down.

As you can see here on the chart from the BLS, job openings are soaring (see the highlighted part) while the unemployment rate holds steady.

In a note to clients this morning, Tim Duy of SGH Macro Advisors notes that this new weird shape of the curve holds true even if you look at alternative measures of non-employment besides the standard U-3 measure: “it appears that labor market frictions not related to unemployment insurance appear to have been increasing. That’s not exactly great news if you are expecting the end of enhanced UI benefits will dramatically ease labor market frictions.”

Obviously there are a lot of people who assume that the labor market will go “back to normal” once the UI expansions expire, childcare becomes easier, the pandemic starts to fade and so on. But at the moment, things are still looking pretty unusual.